- Value

Creation

Story(PDF) - CEO

Commitment - COO Growth

strategy - CHO

COMMITMENT - CFO

COMMITMENT - Development

- Corporate

Governance

Last year, Capcom celebrated its 40th anniversary. This fiscal year marks a new start for the decade ahead. I would like to once more extend our appreciation to our stakeholders for your support.

As stated by our CEO, we began our digital strategy in earnest during the mid-2010s with the aim of expanding global sales of our content and establishing a stable revenue base.

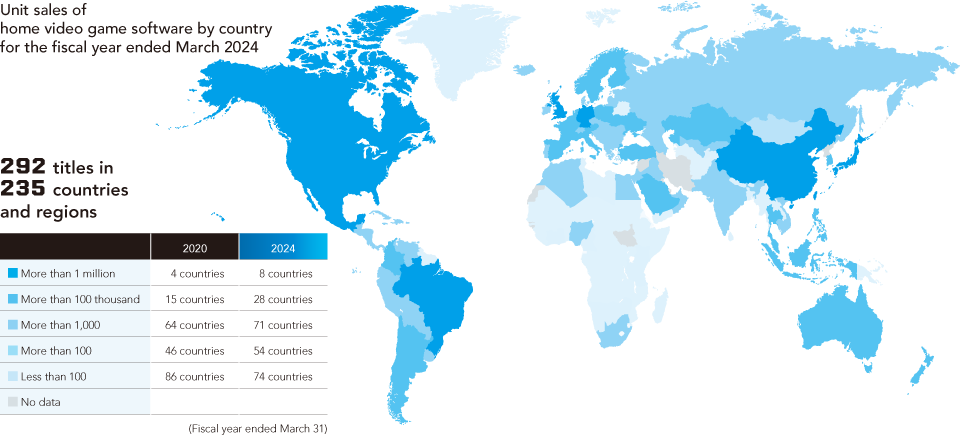

Until that point, game publishers had primarily provided physical disc-based content to game users via retail stores. However, the following restrictions hindered the global expansion of this disc sales model: the limited number of products that can be placed on the shelves, the inability to sell games over the long term because products are replaced within a few months, and the fact that in some countries, retailers take control of the sales price, making it difficult to conduct price promotions. There were also costs associated with anti-copying and anti-piracy measures. To overcome these challenges, we have shifted our focus to digital sales, with our content now reaching more than 230 countries and regions. In addition, our profit structure has shifted away from a hit-driven business model dependent on sales of new titles toward a stable foundation based on sales of catalog titles, leading us to achieve our 11th consecutive year of operating income growth in the fiscal year ended March 31, 2024.

To sustain this growth in the game market over the next decade, we need to further strengthen not only our development system, but also our sales and marketing systems. I am convinced that by consistently producing world-class content, raising brand awareness, and increasing the number of Capcom fans, we will be able to achieve our long-term goal of annual software sales of 100 million copies.

Increasing the number of people who enjoy our content is also in line with our corporate philosophy, which is that we are “creators of entertainment culture that brings you smiles and stimulates your senses.”

Our Measures Thus Far

– Grow markets globally with digitalization –

Changing market landscape

In the era when disc sales were the mainstream, the primary markets were the major developed countries in Europe and North America, with established gaming cultures, where game content was mainly played on dedicated game consoles.

The evolution of game consoles and the spread of the Internet have made it possible to play online and cooperatively with others over long distances, as well as to sell game content digitally through downloads. As a result, game content can be sold over the long term even if it has been on the market for many years, without being affected by retail store operating hours or sales floor space, enabling game publishers to take the initiative in developing pricing policies.

Stepping up our support of the PC platform

Within our Digital Strategy, we have also focused on expanding our support for the PC platform. Since the distribution of dedicated game consoles is inevitably limited to major developed countries with advanced infrastructures, we decided to proactively offer our content on the PC platform in order to acquire more users, as this platform allows us to appeal to customers in emerging countries as well. As a result, we now sell our game content in more than 230 countries and regions, far exceeding the market for conventional game consoles.

Currently, the PC version accounts for nearly 50% of our software sales, but our analysis shows that there is still room for growth, especially in emerging countries.

Data-driven pricing strategy

As I mentioned, the digitalization of game sales has made it possible for game publishers to take the initiative in pricing policies. Thanks to our early shift to digital sales, Capcom has accumulated a vast amount of sales data on which titles sold, at what price, and in what countries in our database. We have spent several years reorganizing this sales data and are now in a position to use it in our future marketing strategy.

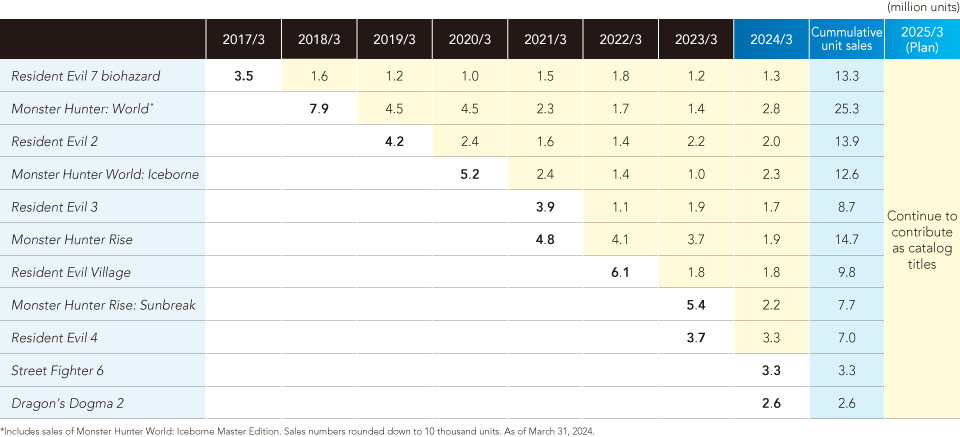

Our basic pricing policy, which is only a general rule of thumb, is to sell titles at approximately 60 to 70 dollars at their release, and then gradually lower the price according to market value, eventually dropping to the 5 or 10 dollar level. We are not just looking for results in a single year, but rather are first aiming to maximize the number of copies sold and profits earned over a period of about five years. Since development costs are typically recovered in about one to two years, even reduced price points are sufficient to contribute to profits.

One good example of this is the long-term sales of Monster Hunter: World. More than six years have passed since its release in January 2018, but last fiscal year, with the announcement of the new Monster Hunter Wilds and the reduction to the attractive price of 9.99 dollars, sales have increased significantly, bringing the total number of copies sold to more than 25 million* cumulatively.

By selling such high-quality titles over a long period of time, catalog titles now account for more than 70% of our annual unit sales, making a significant contribution to our digital content business earnings. This was a major factor in establishing a stable profit structure over the last 10 years.

Comparing our sales territory now with 2020, there are countries and regions where annual sales are gradually shifting from less than 100 units annually to more than 100, more than 1,000 more than 100,000, and more than 1 million units. Indicative of this, as income levels rise due to economic growth in each country and region, we are seeing greater growth of our markets.

Needless to say, there are two factors behind the growth that makes it possible to sell globally over the long term:

(1) From the time the company was established with our main business being arcade game circuit boards, Capcom had already started expanding throughout the world, giving us a brand status and (2) Due to the efforts of our development team, Capcom has the technical and developmental abilities to regularly produce high-quality titles.

* Including Monster Hunter World: Iceborne Master Edition

Looking at the Next 10 Years

– Accelerate sustainable growth with better marketing –

I would like to explain specifically from my perspective as COO the key policies for the next decade as described by the CEO.

According to data from research firms, the global game user population is estimated to be approximately 3.3 billion. While most of them are mobile game users, we estimate that the number of PC and home video game users, our main target, is about 1.5 billion. Considering that we sold 45.9 million units of our video game software in fiscal 2023, we believe that there is still ample room for further growth in this market of approximately 1.5 billion people.

In order to achieve annual software sales of 100 million units, we need to expand sales within this market of approximately 1.5 billion people, and at the same time, strengthen our pipeline of new products by expanding our development system.

Improved marketing by incorporating local characteristics

We have been using our aggregated sales data in our marketing strategy, but we need to improve the accuracy of this approach. By targeting users with information on our latest titles or updates on catalog title prices based on their purchase trends, it will be possible to conduct promotions that appeal to users even more. However, it is not easy to accumulate detailed data linked to individuals. In addition, the laws and regulations of each country regarding the protection of personal information and the protection of minors must be carefully observed. In this context, we will continue to accumulate and analyze data on user purchase and play trends by using the CAPCOM ID, which is an account that can be used across our games and services, as well as by using systems to acquire game play data from within games.

Looking ahead, room for future growth is going to be found in the Global South: in developing and emerging countries that include India. While India has overtaken China in population and is experiencing a high level of economic development, our game sales were not growing at the same rate in India as in China. In autumn 2023, we sent a team to India to conduct research with the help of local businesses and the university community. At this point in time, our analysis indicates that the emphasis in India’s economic development process is on education, and that the country is not yet in a position to actively encourage people to play video games. Based on this research, we have decided not to chase the most recent actual sales, but rather to look five years into the future and work hard to expand the brand awareness of our IP titles and Capcom as a company. If the disposable income and leisure time of people who are interested in games increases, game sales should grow at an accelerating pace in turn.

Regarding such strategic areas of focus, we believe that Southeast Asia, Latin America, and the Middle East will become attractive markets over the next decade. This is because they have large populations and are expected to experience further economic growth. As with India, we need to investigate the actual game culture in these countries and determine the challenges of game sales and the time frame for sales expansion based on real-world information.

With this in mind, we will strive to expand brand awareness by understanding the characteristics of each country and area and implementing price measures in parallel. As part of this effort, we also need to further increase our marketing personnel and strengthen the organization, including those at our overseas subsidiaries. In fact, in emerging countries, catalog titles with significantly lower prices are selling better than new titles with higher prices. With this channel increasing our visibility, by analyzing the timing of purchases and other factors, we will be able to implement effective marketing measures tailored to each country and region, and these measures will lead to market development.

Increased penetration of the Capcom brand using movies

Video content that conveys the world of a game in a short period of time is a powerful tool for increasing Capcom’s brand recognition among people who are unfamiliar with games in general or with Capcom’s titles. This is evident in the past Hollywood movie adaptations of Resident Evil and other titles. In addition to utilizing existing movies based on our games, we are also moving forward with the production of a new live-action Street Fighter movie and TV series, as well as several other projects that are under consideration. As an upfront investment to expand game content worldwide, we will aggressively pursue our movie strategy, not only with theatrical releases, but also through video distribution services and other means.

Increased penetration of the Capcom brand through business and sponsorships

Monster Hunter Now was launched in September 2023, which is a game that was developed and is run by Niantic, a company with strengths in cutting-edge location-based information technology and AR technology in mobile content. We expect this title to increase brand recognition globally by making it easier to play Monster Hunter on mobile and will continue to consider expanding our brand recognition by licensing out our IP to other companies.

In addition, we brought the Resident Evil series to the iPhone15 Pro and other devices last fiscal year. Conventionally, mobile devices have posed some issues in terms of performance capabilities, which made it difficult to port the sort of high-end home video games that are our specialty. On the other hand, as the functionality of mobile devices has gradually improved in recent years, we are now able to offer these games on mobile devices. Currently, the number of people that own mobile devices capable of handling these games is limited, but we believe that in the future, as devices become more sophisticated, this will be a great tool for expanding sales of our content.

The Arcade Operations and Amusement Equipments businesses are each expanding their revenues and contributing to the expansion of our game brands in Japan. The Arcade Operations business is a valuable contact point between Capcom and users, including general consumers, and also provides synergies with the Consumer business sub-segment by acting as a physical venue for game demo events and other activities. The Amusement Equipments business is also expanding its user base and functions as a good match between game content and pachislo machines.

Revenues are at an all-time high in our licensing business thanks to an increase in collaborative products that coincide with the release of new titles and collaborations where Capcom characters appear in other companies’ games. Currently our licensing business is conducted mainly in Japan and the Asian region, but we are moving forward with measures to strengthen the business with global expansion in mind.

Since 2014, in the eSports business we have been holding the CAPCOM Pro Tour throughout the year in up to 160 countries and regions. The final tournament, known as Capcom Cup, is garnering attention as an eSports tournament that will further enliven the global fighting game scene, with the first prize set at one million dollars last season. Capcom Cup 11, to be held in the 2024 season, will take place at Ryogoku Kokugikan arena and again features a prize of one million dollars, following on from last season. In addition to energizing the global eSports market, we will work to further popularize it in Japan.

In order to encourage more people around the world to become Capcom fans and users, it is essential to further expand and increase penetration of our corporate and content brands. To this end, we have also engaged in social contribution activities for local communities, culture, and technologies. These include sponsorship of the Japan Volleyball Association and the soccer club Cerezo Osaka, which were announced in May and August 2024, as well as sponsorship of the Tokyo International Film Festival and exhibiting an interactive attraction titled Monster Hunter Bridge at Expo 2025 Osaka, Kansai, Japan.

Strengthening development capabilities to consistently produce world-class content

To sustain double-digit operating profit growth and to reach annual software sales of 100 million units—both KPIs—we are addressing each of the relevant issues that may arise, one by one. This includes determining what kind of title lineup is necessary, and where to incorporate different titles into our roadmap, including mainline entries in major series such as Resident Evil and Monster Hunter, sequels to existing IPs, reboots, remakes, ports to the latest hardware, and all-new IPs.

We have been able to reliably release two to three new games from our major title pipeline each fiscal year, but we need to increase this number in the future.

Since it is the world’s top-class creators at Capcom who will enable the consistent creation of content, we have been strengthening human capital as a priority management issue for the past two years, and we are bolstering our development system by increasing and training creators.

In the future, the game business may continue to undergo rapid changes, such as the emergence of new technologies including AI-based content development. In addition to maintaining a multi-platform strategy, we have a track record of quickly adapting to new technologies such as VR.

Naturally, we are interested in these new fields and are conducting technical verification. In particular, it is necessary to actively take on the challenge of implementing cross-play, which allows players to play against and cooperate across different hardware, a feature that is in high demand from users. The key is to use new technologies to provide users with a new gaming experience. Even cutting-edge innovations are meaningless if the game is not interesting. By implementing these initiatives and more, Capcom expects to sustain its growth trajectory in the years to come.

Finally, I want to properly convey that although our business format may change, Capcom’s top priority will not. That is to consistently produce world-class, meticulously refined content as we have always done. If our salespeople are properly communicating our appeal, then consumers will always choose our products, even if the platforms or services change. Conversely, if our content or services are deficient, even if we are able to ride the transient wave of a trend, growth will not be sustainable. We are convinced of this based on our experience standing at the forefront of the industry.

CAPCOM INTEGRATED REPORT 2024

Full text PDF

Split version PDF

Value Creation Story

- Creating Financial and Non-Financial Value

- Corporate Philosophy and Vision Table of Contents and Editorial Policy

- Value Creation Model

- History of Value Creation

- Major Intellectual Properties (IP)

- Effectively Leveraging IP

- Sustainability Highlights

- Financial Highlights

- Business Segments Highlights

- Global Sales Strategy

- Medium- to Long-Term Vision